DIS at a Glance

The Default Investment Strategy ("DIS") commenced on 1 April 2017. It is a ready-made and low cost investment strategy designed for MPF members who do not have time, or do not know how to make investment decisions. The DIS standardizes the default arrangements of the MPF schemes. In the new arrangement, the MPF benefits of members who do not give an investment instruction would be invested automatically according to the DIS. Members can also actively select the DIS or funds under the DIS if they find that the solution suits their own circumstances. You can know more about the key features of the DIS here.

DIS "1,2,3"

ONE

Investment Solution

Ready-made and low cost

TWO

Constituent Funds

- Core Accumulation Fund ("CAF")- 核心累積基金

- Age 65 Plus Fund ("A65F")- 65 歲後基金

THREE

Features

- Fee cap: Management fee: 0.75% p.a. of NAV

Out-of-pocket expenses: 0.20% p.a. of NAV - Age-based de-risking

- Globally diversified investment principle

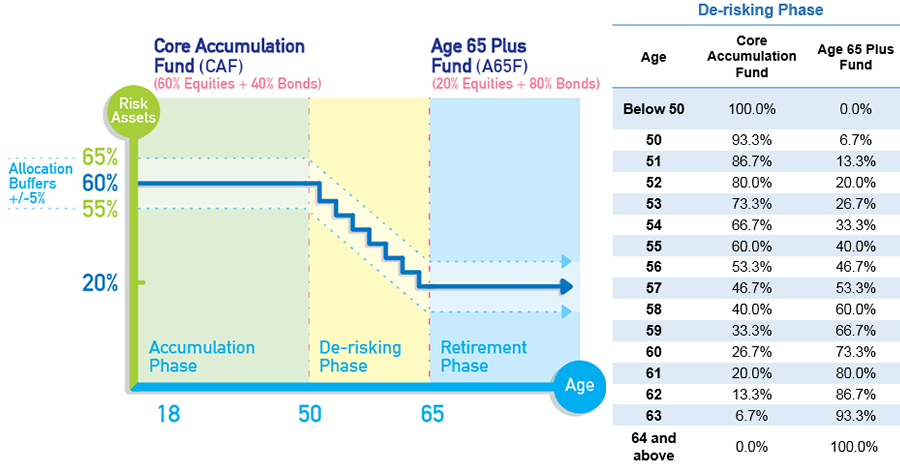

How does “Age-based De-risking” work?

As an MPF member approaches retirement age, the investment strategy will be progressively adjusted to reduce the proportion of higher risk assets. The age-based de-risking will be generally carried out on members' birthday.

- Aged below 50: All MPF contributions will be invested in the CAF.

- Aged 50 to 64: The accrued benefits in the CAF will be gradually shifted into the A65F, at a rate of around 6.7% of assets every year.

- Aged 64 and above: All MPF assets will be held in the A65F.

Things to Note

- As various investment approaches (active, passive, hybrid, etc.) can be adopted for different DIS funds under different schemes:

- The DIS is also for members to choose as an active choice:

| Active Investment Option | De-risking Applies |

|---|---|

| DIS (the strategy) | |

| Core Accumulation Fund Age 65 Plus Fund |

- DIS does not guarantee capital or positive returns. Similar to all investments, DIS is subject to investment risks and it involves risks applicable to mixed asset funds.

- DO NOT rush to go into the DIS.

- Be aware of fee and risk profile differences between original default fund and the DIS (especially if the original default fund is a low risk fund).

Webcast

DIS Notices and Materials

To know more about the DIS, please refer to the notices, MPF Scheme Brochure and other materials at our Download Zone.