The method of calculating contribution for your casual employees differs from that of regular employees. Regardless of whether the casual employees are daily-paid or non-daily paid, there is a unified contribution scale as below:

Daily-rated casual employee

| Daily Relevant Income (HK$) | Employer’s Mandatory Contribution (HK$) | Casual Employee’s Mandatory Contribution (HK$) |

|---|---|---|

| Less than $280 | $10 | Not required |

| $280 to less than $350 | $15 | $15 |

| $350 to less than $450 | $20 | $20 |

| $450 to less than $550 | $25 | $25 |

| $550 to less than $650 | $30 | $30 |

| $650 to less than $750 | $35 | $35 |

| $750 to less than $850 | $40 | $40 |

| $850 to less than $950 | $45 | $45 |

| $950 or more* | $50 | $50 |

Non daily-rated casual employee

For a casual employee who is not daily-rated but is, for example, employed on a fixed weekly or monthly rate, you need to calculate his / her average daily relevant income, then use the corresponding income band under the above contribution scale to determine the applicable daily contribution amount, and finally calculate the total contribution payable for the week or month.

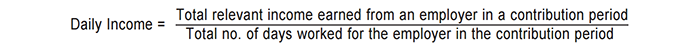

In relation to a non-daily-rated casual employee, the average “Daily Income” is determined as follows:

Before making contribution for casual employees, employers should decide on the definition of the contribution day.

Option 1: Employers should pay contribution on or before the next working day subsequent to the payment of relevant income. If the contribution day falls on a Saturday or public holiday, it will be extended to the next working day.

Option 2: Employers should pay contribution within 10 days after the contribution period.

For more contribution details, please click here